Every person in the world, regardless of their financial condition, has bank accounts to save their earnings. Do you all know that the origin of the bank started in the Roman Empire during the Babylonian period? Yes, they practiced banking to check on the valuables and goods in the treasury. However, modern banks are more systemized than the banks in olden days.

Banks are like financial institutions that act as an intermediary in financial transactions. They are responsible for accepting deposits, giving loans, clearing checks, etc.,

Due to the evolution of banks transactions were made uniform with certain laws, rules and regulations. Centralized banks were introduced to govern other banks. These banks should run according to the government rules. Previously, people used to stand in line to get services (Cash withdrawals, deposits, loans, etc.,). With the advancement of technology, banks started providing ample services such as Internet banking, ATMs, and digital services to their customers.

The banks that provide financial services to their customers are called commercial banks. These banks offer basic investment products, approve deposits, and give business loans to small, middle, and large-scale enterprises. Commercial banks are licensed by law to accept money from different organizations/enterprises as well as individuals and lend money to them. These banks are formulated by the federal and state laws and controlled by the Federal Reserve System.

A Commercial bank provides the following services:

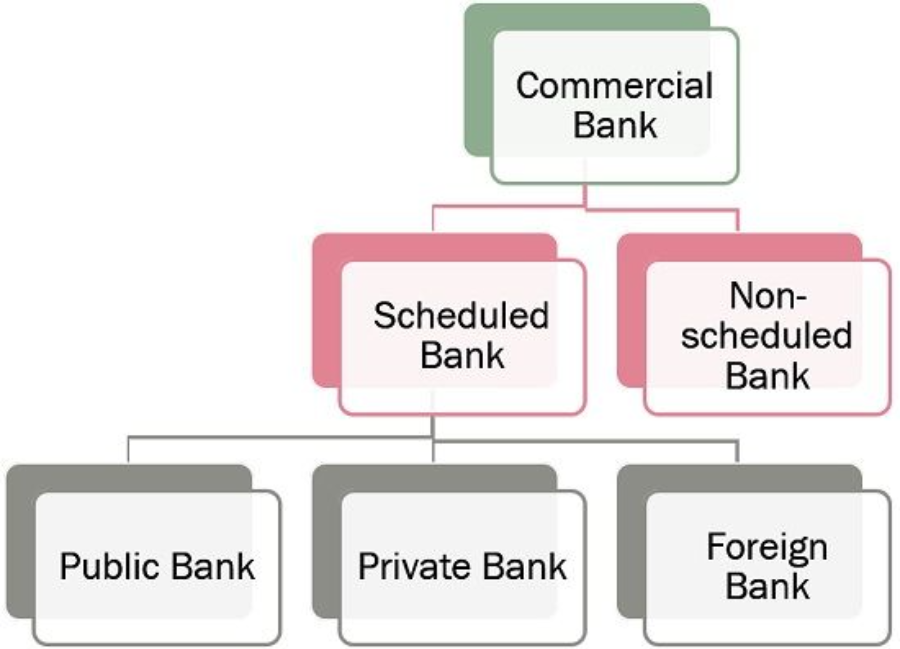

Commercial banks are classified into two types:

Scheduled Banks: These banks run based on the rules and regulations of RBI. Scheduled banks have paid up capital and deposits on an average value of not less than five lakh rupees in RBI. Most of the banks in India come under this category and they have operations in foreign countries.

Non-Scheduled Banks: The banks that have paid up capital and deposits an aggregate value of less than five lakh rupees in RBI are called as Non- Scheduled banks.

I hope my readers loved it.

Thanks for reading.