UPI - Payments Review:

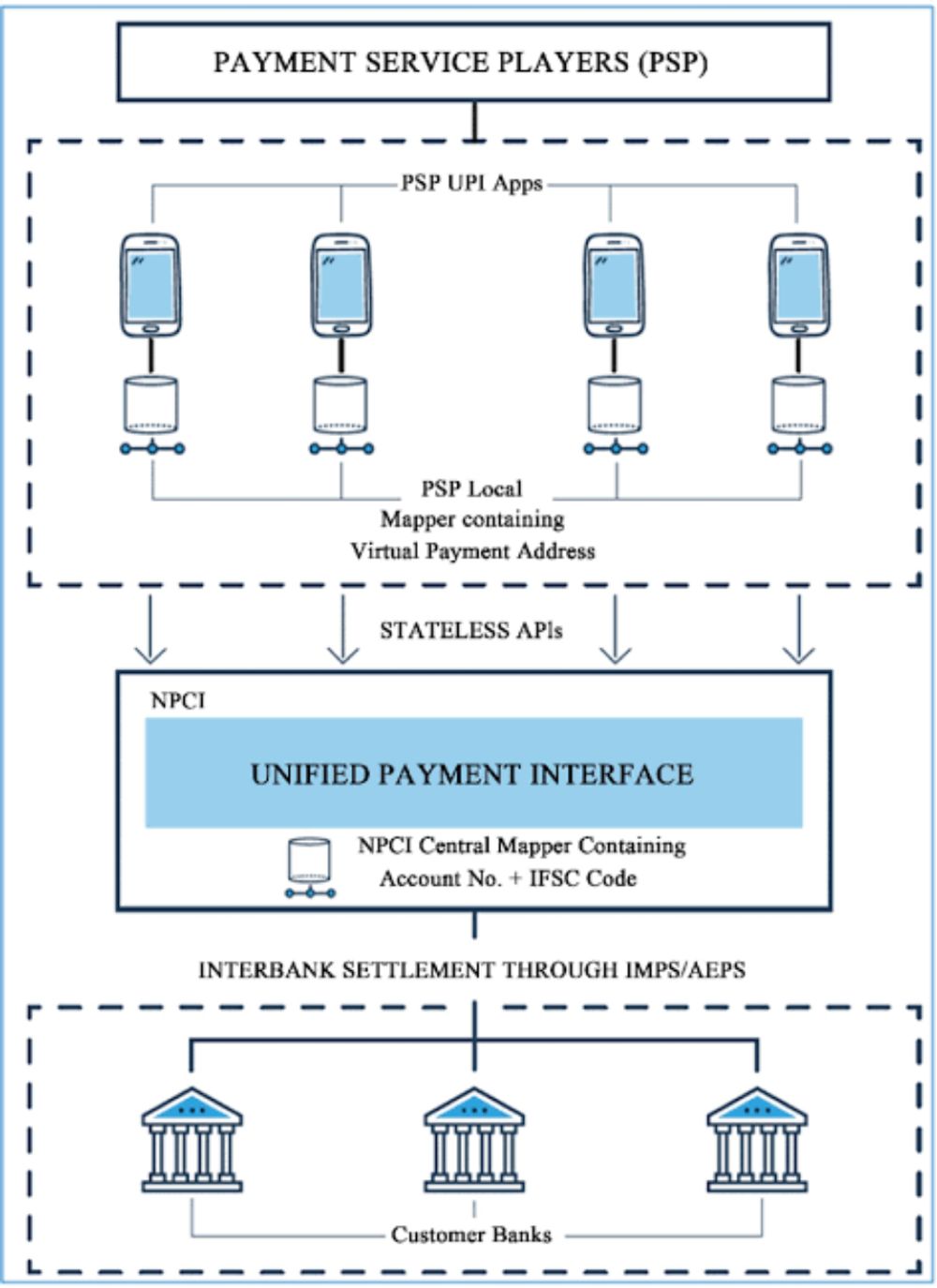

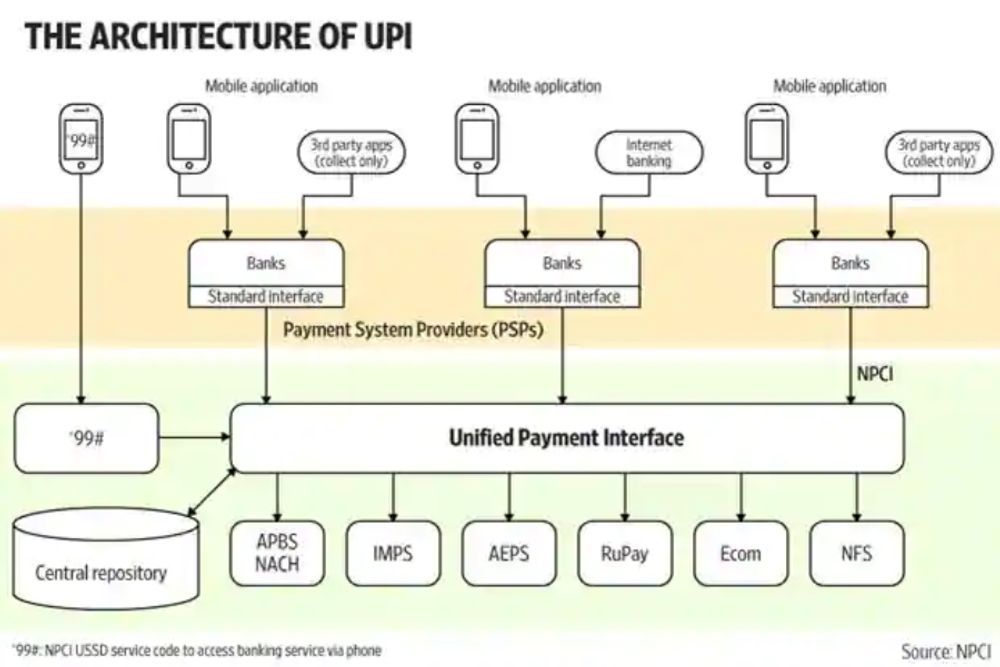

UPI refers to Unified Payments Interface has been introduced by NPCI - National Payments Cooperation of India.

The main objective of UPI Payments setup is to fascinate digital micro payment at scale.

Another reason is provide a hussle-free digital payment transactions between bank holders and customers.

The main goal is to remove demonetization of currency notes & payments through electronic payments system.

Electronic payments gateway apps are being automatic verified before any vulnerability has occurred.

In order to promote high security implemented to banking systems and payment service banks has provide a secure 4 digit PIN to their customers.

But in case of UPI Security flaws bank has send a 4 or 6 digit pass code to login in the bank account details.

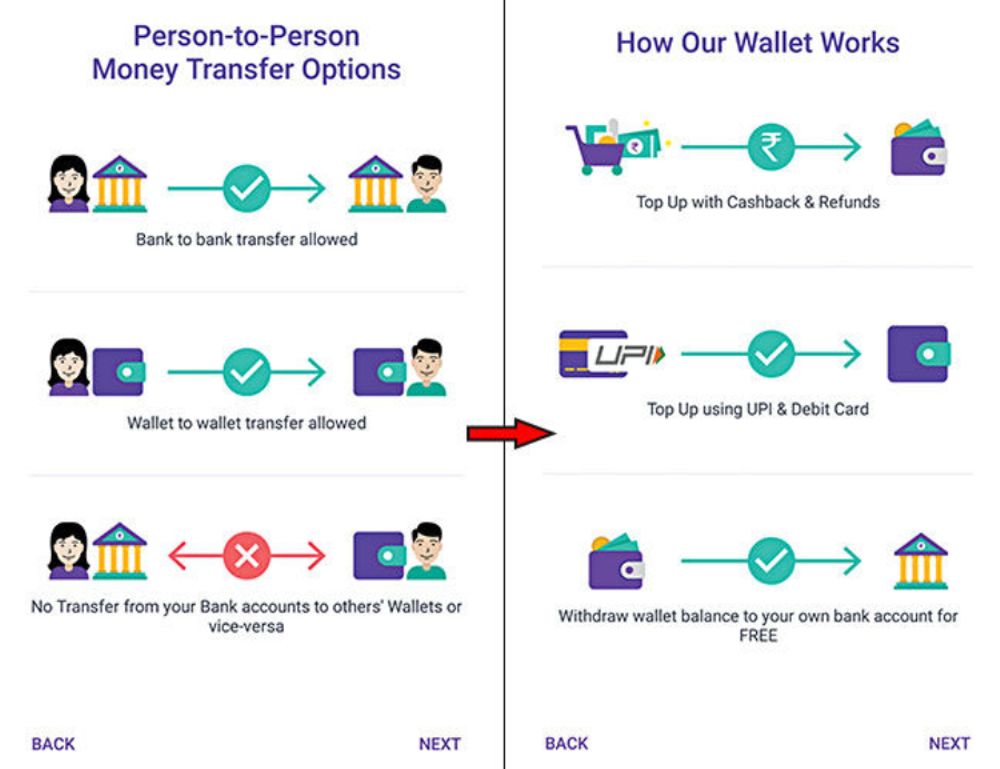

While for transaction another secret code of 4/6 digit is to enter for transfer & transact the amount from one bank to another bank including other payments like Electricity bills, booking LPG Gas, and Mobile ,DTH Recharges are popularly done through UPI payments.

A process of coding and programming & anti- emulation methods and techniques are required to operated the Unified Payments Interface system.

People used popular UPI Apps like Google Pay, BHIM, Paytm, Phonepe Amazon Pay Samsung Pay Ola Money they used to fulfilled their activities.

UPI - User Registration Process -I

User Registration through UPI App requires Alice setups: Required cellphone to send & received money, requires a user mobile device number -

Needs a proxy to check user's digital identity that means to verify that number may linked with bank account.

Mobile number associate with bank details are required KYC for send & receive money through two factor OTP authentic process via SMS and voice massages.

While on the other hand, to secure and safetyness of the User account the bank require a complete KYC process which is being done by biometric process verified by screening User ID provide by Govt.

UPI - User Registration Process - II

To setup a user profile an outbound encrypted sms has been send by Alice device to UPI server makes stronger security and maintenance between UPI server and user device

UPI Pass code is an optional for pass code authentic process where user can access to two servers one is UPI servers verifies through Fingerprint and UPI PIN whereas the other one is Payment server to verify the app pass code by the user .

Afterwards user have to choose her bank account where UPI server fetched the bank account with IFSC codes associated with user registered mobile number.

All digital transactions are being processed by cell number register with bank account and IFSC codes instantly done by user's fingerprint and UPI PIN. All transactions are accessible by two-factor authentic process.

Thank You For Reading